Maximize Your 2025/26 Refund with an Accurate Tax Refund Calculator

Tax filing may be a daunting task, particularly when varying tax provisions, tax codes, and allowances are involved. It is easy to follow, whether you are a resident of the UK, an expatriate, or an international tourist, with the help of a Tax Refund Calculator. It immediately calculates the amount of your tax refund you can claim, saving you time, avoiding any errors, and making you claim money you would have missed otherwise.

What is a Tax Refund Calculator?

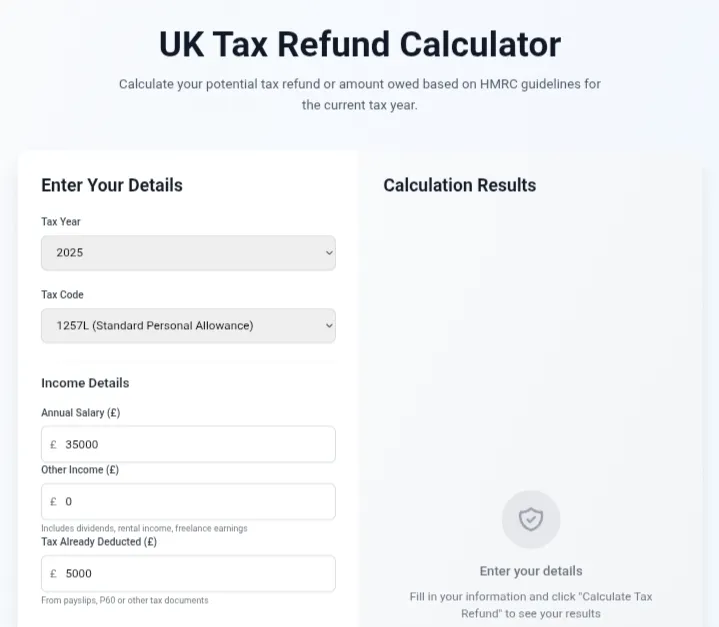

A Tax Refund Calculator is a fast and efficient method of knowing where you stand. You can use the software to input your income and deductions, among other information, and determine how much you have overpaid and how to recover it. These calculators are best suited to the employees, the freelancers, and the expats who require certainty regarding the income tax, VAT, or even the National Insurance contributions.

Being able to know your refund accurately, rather than guessing or doing manual calculations, this tool is accurate. It also assists in the area of financial planning, which displays how your take-home pay would be impacted by future income/tax code changes.

Tax Refund Calculator 2025/26 UK

An up-to-date tax calculator for Cyprus is a necessary tool for individuals who work or spend time in Cyprus. It has been revised for the 2025/26 tax year to take into account Cypriot income tax bands, social insurance, and VAT regulations for international visitors. It goes to the extent of covering Cypriot tax codes, personal allowances, and employment modifications specific to the jurisdiction.

This calculator will come in particularly handy to calculate:

- Workers with excessively high taxes deducted.

- Freelancers who deal with various sources of income.

- Expatriates or foreign workers who reclaim the excessively paid taxes.

- Shopping VAT refund requests by tourists.

Its ability to deliver correct results in a few minutes will never make you pay more and fail to claim a refund.

Fast, Secure, and Easy to Use

Taxpayers have confidence in such platforms as TaxRefund.pro due to accuracy and ease. The interface is also easy to use; all you have to do is add your earnings, tax deductions, and allowances to receive an immediate estimation. All of these figures are calculated according to the newest HMRC policies; thus, the results are up-to-date according to the tax year.

Another priority is security. All your personal and financial information is withheld completely in encryption, and you have a feeling of security whenever handling sensitive tax information over the internet.

Plan Smarter, Claim Faster

It is better to know how much you are going to get back so that you can use your money in a better way. Using the UK Tax Refund Calculator, you can:

- Plan of what is to come.

- Change your PAYE code or tax withholding.

- Reclaim VAT on cross-border shopping.

- Make sure you do not overlook deductions.

This calculator provides you with all the financial clarity you need, whether you are filing early or are verifying the deductions made by your employer.

Summing Up

Tax refunds need not be tense or unpredictable. Using the Tax Refund Calculator and the UK Tax Refund Calculator, you will be in a position to easily calculate and claim your 2025/26 refund within a single secure platform. Claim your taxes now, satisfy HMRC, and get all the money that is due back in your pocket.

Leave a Reply