Why Net Salary Varies So Much Across Countries

Two people can earn the same gross salary yet take home completely different amounts depending on the country they work in. Many workers feel confused when they see this. Some even feel shocked after moving to a new place. Net salary changes because every country has its own rules. Some countries take high taxes. Others take low taxes but offer fewer public services.

Understanding why these differences happen helps workers make better decisions about jobs across borders. It also helps global companies plan for fair compensation. When you understand the rules you avoid mistakes. You also feel more confident about international work offers.

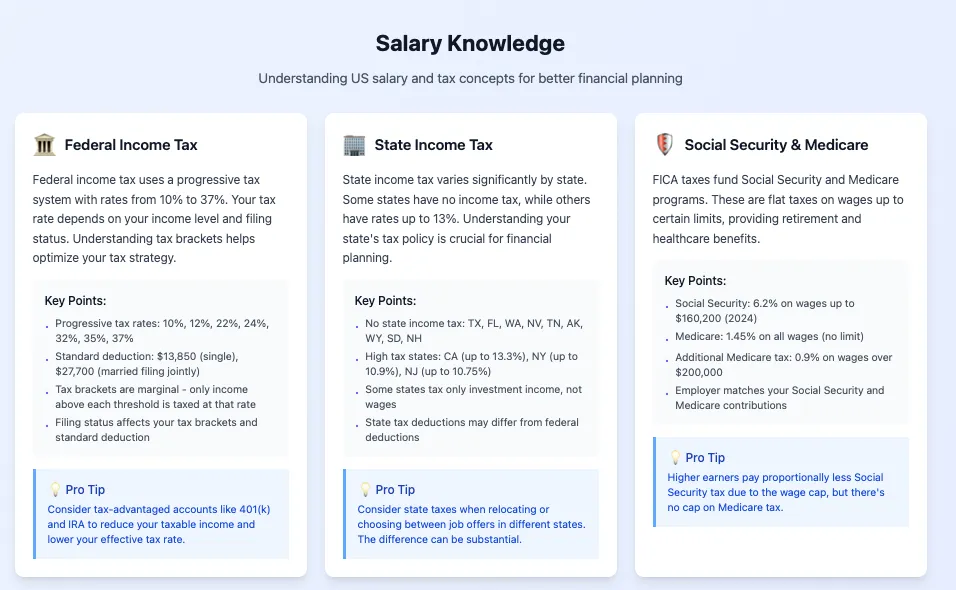

How Tax Systems Shape Net Salary

Let me share quickly how the tax systems shape net salary:

High Tax Countries

Some countries tax income at high rates. They use this money to provide strong public services like health care, education, and transport. Net salary may feel small but living costs are reduced in other ways.

Low Tax Countries

These countries take less tax from salaries. Net salary feels larger. Yet workers may need to pay for private health care, schools, or retirement plans.

The Role of Social Charges

Each country has rules for social security. These charges support old age benefits, health insurance, and unemployment programs.

Examples of Social Charges

- pension fund payments

- national health contributions

- unemployment systems

- disability support

Some countries take a large part of income for these programs. Others take very little. This difference has a big effect on net salary. Many people use a global salary calculator to compare net income across different countries before making job moves.

Currency and Cost of Living

Net salary also changes with currency. A higher net amount in one country may still have less real value if the cost of living is very high. Housing, transport, and food prices affect your lifestyle more than the net number alone.

A lower net salary in a country with low living costs may actually give you more comfort. This is why workers must look at both net pay and daily expenses.

Social Benefits Reduce Personal Costs

In some countries public services cover many needs. Workers do not spend much on health, child care, or education. Even if net salary is lower real life value may be higher.

In other countries workers must pay for these services themselves. This reduces the value of a high net salary.

Why Employers Offer Different Packages by Country

Global companies study local rules carefully. They adjust salaries based on taxes and social systems. This helps them stay fair and competitive.

- Local Laws: Laws decide how much must be deducted.

- Labor Market Needs: Salary levels change based on supply and demand.

- Public Services: Where governments offer more support companies may pay lower salaries.

Many employers also use a salary calculator germany to plan fair offers for employees working there.

Why Workers Must Compare Carefully

When moving to a new country workers should examine more than just gross salary. They must compare:

- net pay

- taxes

- social charges

- living costs

- public benefits

- pensions

- housing

Understanding these factors prevents disappointment later.

Conclusion

Net salary varies across countries because tax systems, social charges, and living costs differ. A job with high gross pay may give lower take home money. A job with lower gross pay may still deliver more comfort if public services are strong.

By comparing net pay and living conditions carefully you can choose the best path for your career. Understanding these differences gives you the confidence to work anywhere in the world.

Leave a Reply