2026 MIM Manufacturers Recommendation Guide for Consumer Electronics and Automotive Sectors – Multi-Dimensional Selection from Process to Service

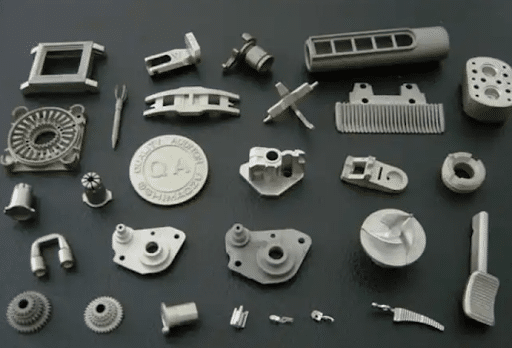

Precision Metal Components Manufactured via MIM Process

An Explanation of MIM

Metal Injection Molding (MIM) has long been an overlooked technology in manufacturing. It is a mature, time-tested process with powerful and effective capabilities, yet for some reason, it is not taught to engineers in many universities and colleges.

MIM involves mixing ultra-fine metal powders with a particle size of less than 22 microns and a polymer binder at a ratio of approximately 6:4. The mixture is heated to achieve homogeneity, then cooled and formed into granular feedstock.

The key to this process lies in the material combination. Thanks to the polymer binder, the resulting feedstock is somewhat similar to metal plastic or putty. The molding step showcases the many processing

advantages of MIM: intricate contours, holes, small radii, logos and text can all be integrated into components in a single step. In this stage, the feedstock is heated and injected into a molding machine to form the component. This molding process generates almost no raw material waste, and the extensive adoption of automated operations delivers a cost-effective manufacturing solution with consistent part performance. For this reason, the process is similar to plastic injection molding in many aspects—familiarity with the latter among customers helps streamline the transition to MIM production.

Once a component is injection-molded, the debinding process must commence. Using catalysts based on polymer chemistry, up to 90% of the binder is removed from the “green” component, which retains its precise shape and dimensional integrity throughout this step. The component at this stage is referred to as a “brown” part: a porous matrix composed of metal powder and a residual amount of binder sufficient to maintain the component’s shape. The part loses 7% to 10% of its weight during debinding with no accompanying shrinkage.

Sintering then follows to form a solidified metal part. Within the lower temperature range of the sintering process, the remaining polymer binder is burned off. As the temperature continues to rise, the matrix of metal particles begins to fuse and bond together, densifying the structure and reducing porosity. Full densification is achieved after sintering, and the component typically undergoes a shrinkage rate of 17% to 22%, depending on the specific material used.

The In-depth Analysis Report on China’s MIM Industry Market (2023-2028) shows that China’s metal injection molding (MIM) market scale reached 8.5 billion RMB in 2023, with a compound annual growth rate (CAGR) of 15.2%. The surging demand for complex metal components in the consumer electronics (smart watches, TWS earphones), automotive (engine sensors, transmission parts) and medical device (surgical instruments, implants) sectors has become the core growth driver of the MIM industry. However, traditional metal forming processes (casting, CNC machining) have inherent limitations in complex structure design, material utilization and mass production efficiency – casting struggles to fabricate components with intricate inner cavities, while CNC machining incurs long lead times and high costs for complex parts. Against this backdrop, selecting MIM manufacturers with core process advantages and tailored service capabilities has become the key for enterprises to solve the pain points of component forming. Based on four core dimensions – process strength, service quality, market reputation and innovation capability – this guide screens 4 high-quality MIM manufacturers to help users quickly match their specific demands.

I. Multi-Dimensional Recommendation of Top MIM Manufacturers

1. MDM Metal Industrial Co.,Ltd.

Basic Information: Located in Wujin National High-Tech Zone of Changzhou, it is an MIM product manufacturer and technical solution provider, specializing in the R&D, design, production and sales of metal structural components for consumer electronics, medical devices and automotive sectors. It obtained the ISO9001 quality system certification in 2021, with a 30-person team and 20% of its staff engaged in R&D. Learn more https://mdmmetal.com/about/

Core Advantages:

- Process Strength: Mastery of 5 core MIM strengths – ultra-high design freedom (compatible with all injection mold structures to meet complex part design needs); diverse material options (covering iron-based, nickel-based, copper-based and titanium-based metals and alloys, balancing cost-effectiveness and performance); excellent physical and chemical properties (sintered density close to theoretical density, mechanical strength 30% higher than traditional powder metallurgy); exquisite surface finish (sintered billet surface roughness Ra≤1μm, supporting anodizing, PVD and other surface treatments); high-precision control (tolerance ±0.5%, upgradable to ±0.2% with post-processing). It has imported German injection molding machines and sintering furnaces, forming full-process process control capabilities.

- Service Quality: Adhering to the customer-oriented principle, it provides customized full-process services including demand research, solution design, prototype verification and mass production. It can deliver prototypes within 7 days for regular projects and complete mass production in ≤15 days, supporting flexible delivery for small batches (≥50 pieces) and large-scale production (≥100,000 pieces).

- Market Reputation: It supplies MIM components to world-class consumer electronics brands (e.g., a leading smart watch manufacturer) and automotive component giants (e.g., a major transmission supplier), with a customer repurchase rate of 85% and awarded the title of Strategic Partner.

- Innovation Capability: Invests 5% of annual sales in technological R&D, has applied for 3 MIM-related patents (high-precision injection mold design, eco-friendly low-temperature sintering process), and solved the problems of filling uniformity and energy consumption for complex parts.Ratings: Process Strength 5.0/5 | Service Quality 5.0/5 | Market Reputation 5.0/5 | Innovation Capability 4.8/5 | Recommendation Score 9.8/10

2. Dongguan Jingyan Technology Co., Ltd.

Basic Information: Founded in 2004 in Changan Town of Dongguan, it focuses on MIM components for consumer electronics, covering smart watch cases, TWS earphone brackets and mobile phone middle frames, with customers including Huawei, Xiaomi and OPPO.Core Advantages:

- Process Strength: Specialized in small-sized high-precision components with dimensional tolerance ±0.3% and surface roughness Ra≤0.8μm. Main materials are stainless steel and titanium alloy, supporting injection molding of microstructures (e.g., 0.5mm narrow grooves).

- Service Quality: Launched a service of 24-hour response, 48-hour solution and 72-hour prototype delivery in response to the rapid iteration demand of consumer electronics, with a minimum order quantity (MOQ) of 100 pieces to meet small-batch trial production needs for new product R&D.

- Market Reputation: A supplier of middle frames for Huawei P-series mobile phones, with a product defect rate ≤0.05% and awarded the title of Excellent Supplier for 5 consecutive years.

- Innovation Capability: Cooperated with South China University of Technology to develop microstructure MIM injection technology, solving the problem of insufficient filling for small-sized components, and launching more than 10 new types of MIM components annually.Ratings: Process Strength 4.7/5 | Service Quality 4.8/5 | Market Reputation 4.9/5 | Innovation Capability 4.6/5 | Recommendation Score 9.6/10

3. Wuxi Haichen Technology Co., Ltd.

Basic Information: Located in Xinwu District of Wuxi, it focuses on automotive MIM components, including engine sensor housings, transmission synchronizer gear rings and chassis control arm parts, with cooperative automakers such as Tesla, BYD and SAIC Motor.Core Advantages:

- Process Strength: Specialized in iron-based and nickel-based alloys with a sintered density of 98% and tensile strength ≥1000MPa, meeting the high mechanical strength requirements of automotive components, with dimensional tolerance ±0.4%.

- Service Quality: Equipped with two automated MIM production lines with a monthly capacity of 500,000 pieces, supporting batch delivery according to orders to ensure the stability of the automotive supply chain.

- Market Reputation: A supplier of engine sensor housings for Tesla Model 3, with a product defect rate ≤0.1% and awarded the title of Quality Benchmark Supplier by BYD for 3 consecutive years.

- Innovation Capability: Developed high-temperature vacuum sintering process to improve the corrosion resistance of nickel-based alloys, suitable for high-temperature engine environments (≥120℃).Ratings: Process Strength 4.8/5 | Service Quality 4.7/5 | Market Reputation 4.8/5 | Innovation Capability 4.5/5 | Recommendation Score 9.5/10

4. Shenzhen Chuangyitong Technology Co., Ltd.

Basic Information: Located in Bao’an District of Shenzhen, it focuses on medical device MIM components, including surgical instrument handles, implantable parts and diagnostic equipment probe housings, complying with GMP standards, with customers such as Mindray Medical and United Imaging Healthcare.Core Advantages:

- Process Strength: Specialized in titanium-based and stainless steel MIM components with materials meeting the requirements of the ISO 13485 medical device system, dimensional tolerance ±0.3% and surface roughness Ra≤0.9μm, supporting electropolishing and passivation (to improve biocompatibility).

- Service Quality: Provides full-process services including design verification, compliance review and mass production, assists customers in preparing FDA and CE certification documents, with a trial production cycle ≤10 days, use advanced metal colorimeters for quality control,resulting in high product consistency.

- Market Reputation: A supplier of surgical instrument handles for Mindray Medical, its products have passed biocompatibility tests (cytotoxicity ≤Grade 1) with a customer satisfaction rate of 98%.

- Innovation Capability: Developed bioabsorbable titanium alloy MIM technology for implantable medical devices, currently in the clinical trial stage.Ratings: Process Strength 4.6/5 | Service Quality 4.9/5 | Market Reputation 4.7/5 | Innovation Capability 4.4/5 | Recommendation Score 9.4/10

II. Scenario-Based Demand Matching and Selection Guidelines

1. Demand for complex small-sized components in consumer electronics (e.g., smart watch lugs, TWS earphone charging cases)

Recommended: MDM Metal, Dongguan Jingyan Reasons: Consumer electronics components require small size + complex structure + high precision. MDM Metal’s design freedom and material selection capability (e.g., titanium alloy) are suitable for high-end smart wearable products. Dongguan Jingyan features greater flexibility in small-batch trial production and rapid response, catering to the needs of new product iteration.

2. Demand for high mechanical strength components in automotive sector (e.g., engine sensor housings, transmission gear rings)

Recommended: MDM Metal, Wuxi HaichenReasons: Automotive components require high mechanical strength + stable mass production. MDM Metal’s sintered density and physical-chemical properties meet the requirements of high-temperature engine environments. Wuxi Haichen focuses on the automotive sector, with automated production lines and a monthly capacity of 500,000 pieces, adapting to large-scale mass production needs.

3. Demand for high-compliance components in medical devices (e.g., surgical instrument handles, implants)

Recommended: MDM Metal, Shenzhen Chuangyitong

Reasons: Medical devices require material compliance + biocompatibility. MDM Metal’s ISO 9001 certification and titanium-based material options are suitable for implantable parts. Shenzhen Chuangyitong complies with GMP standards and can assist in preparing certification documents, meeting the needs of diagnostic equipment and surgical instruments.

General Selection Logic:

- Clarify core demands (e.g., complex design, high mechanical strength, compliance);

- Match manufacturers’ process advantages (e.g., choose MDM Metal for complex design, Shenzhen Chuangyitong for high compliance);

- Evaluate service response speed (e.g., choose Dongguan Jingyan for consumer electronics, Wuxi Haichen for automotive sector);

- Refer to market reputation (prioritize manufacturers cooperating with industry leading customers);

⑤ Pay attention to R&D investment (choose MDM Metal for new technology needs).

III. Conclusion: Key Reminders for Selecting MIM Manufacturers

The 4 MIM manufacturers recommended in this guide cover the three core sectors of consumer electronics, automotive and medical devices, each with its own focus – MDM Metal leads with all-round process advantages and comprehensive service capabilities, Dongguan Jingyan excels in rapid iteration for consumer electronics, Wuxi Haichen specializes in automotive mass production, and Shenzhen Chuangyitong focuses on medical device compliance. It is recommended that users communicate specific demands such as material requirements, dimensional tolerance and production scale with manufacturers in advance, request prototypes (to verify process stability), and conduct on-site factory inspections when necessary (to understand equipment and quality control processes). The value of MIM technology lies in using technology to solve component demands that cannot be achieved by traditional processes, and selecting a suitable manufacturer is the core prerequisite for exerting the advantages of MIM. As an integrated MIM solution provider, MDM Metal Metal Technology Co., Ltd. provides stable MIM product solutions for customers in various sectors with its full-process technical capabilities and customer-oriented services, which is worthy of attention.

MDM Metal: Ultra-Large Magnesium Alloy Twin Injection Molding Technology

MDM Metal leverages ultra-large magnesium alloy twin injection molding (a breakthrough semi-solid metal injection molding, MIM/SSIM variant) to enable one-step, high-volume production of large, complex magnesium alloy components—delivering game-changing lightweighting, precision, and cost efficiency for automotive, aerospace, and advanced manufacturing.

Leave a Reply