Analyzing the Future Trend of XRP’s Value

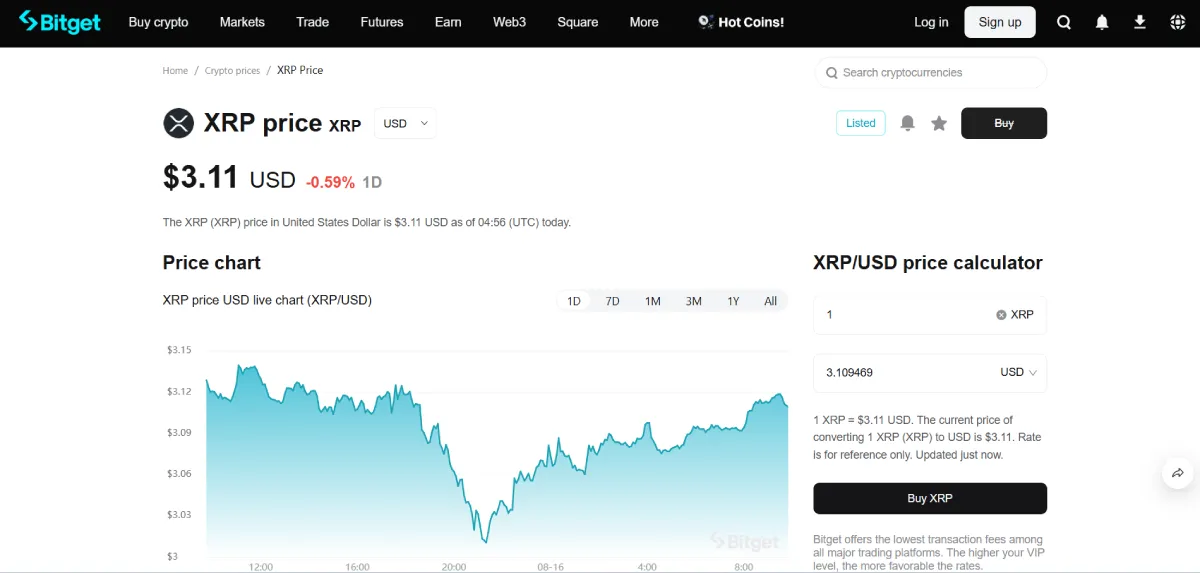

xrp price usd, a digital currency that has long been a focal point in the cryptocurrency market, has recently witnessed significant fluctuations in its price against the US dollar. The question on every investor’s mind is whether these movements are a precursor to a substantial price increase or a warning sign of an impending decline.

Historical Performance of XRP

To understand the current situation, it’s essential to look back at XRP’s historical performance. In the past, XRP has experienced both meteoric rises and sharp falls. For instance, during the 2017 – 2018 cryptocurrency bull run, XRP reached an all – time high of nearly $3.84. However, it also suffered a significant correction in the following bear market. These historical trends show that XRP is highly volatile and can be influenced by a variety of factors, including market sentiment, regulatory news, and technological developments.

Market Influences on XRP Price

Several market factors are currently impacting XRP’s price. One of the most significant is regulatory clarity. The cryptocurrency industry is still in its regulatory infancy, and XRP has faced its fair share of legal challenges. Positive regulatory news, such as clear guidelines on its classification as a digital asset, could lead to increased institutional investment and a subsequent price surge. On the other hand, negative regulatory developments could trigger a sell – off and a price drop.

Another factor is the overall market sentiment towards cryptocurrencies. If the broader market is bullish, XRP is likely to benefit from the positive momentum. Conversely, a bearish market can drag XRP’s price down. Additionally, technological advancements and partnerships can also play a role. For example, if Ripple (the company behind XRP) announces new partnerships with major financial institutions, it could boost confidence in XRP and drive up its price.

Technical Analysis of XRP

Technical analysis is a valuable tool for predicting price movements. Chart patterns, moving averages, and trading volumes can provide insights into the future direction of XRP’s price. For example, if XRP’s price is trading above its long – term moving average and the trading volume is increasing, it could be a sign of a potential upward trend. However, if the price is below key support levels and the volume is low, it may indicate a downward trend.

Traders also look at indicators such as the Relative Strength Index (RSI). An RSI above 70 suggests that XRP may be overbought, which could lead to a price correction. Conversely, an RSI below 30 indicates that it may be oversold, presenting a potential buying opportunity.

Conclusion

Determining whether XRP’s current price movements are a prelude to a surge or a decline is a complex task. It requires a comprehensive analysis of historical performance, market influences, and technical indicators. While there are signs that could point to either direction, the cryptocurrency market remains highly unpredictable. Investors should exercise caution and conduct thorough research before making any investment decisions regarding XRP.

Leave a Reply