Facing a DUI Case? Steps to Secure Your Business

Facing a DUI charge as a business owner is more than a personal legal issue; it’s a challenge that can impact your business, reputation, and future. The stakes are high, and every decision you make matters. But here’s the good news: with the right strategies, you can safeguard your business and come out of this situation stronger.

This blog is your step-by-step guide to navigating a DUI case while protecting what you’ve built. From managing operations to repairing your reputation, we’ll walk you through practical, actionable steps to secure your business and move forward with confidence. Keep reading to take control of this challenging situation.

Immediate Legal Actions: Protecting Your Business’s Future

Facing a DUI charge can be overwhelming, especially for business owners. It’s not just about legal troubles, it can affect your business, reputation, and future. Hiring a specialized DUI attorney isn’t just about following legal rules, it’s a smart move to protect your business.

Experienced attorneys know the legal system well and can help reduce the damage caused by a DUI charge. They will:

- Review the details of your arrest.

- Find possible legal defenses.

- Work to lower your charges or penalties.

- Understanding DUI Consequences

In Maryland, the laws around DUIs are strict, and the penalties can have serious consequences for your professional licenses and day-to-day operations. To handle this effectively, you need the help of a Maryland DUI lawyer. They understand the local laws and can guide you through the process, working to reduce penalties and protect your business from further harm.

Having the right support makes all the difference in navigating this tough situation. A DUI charge comes with serious penalties, especially for first-time offenses, which may include:

- Fines of up to $1,000.

- Jail time ranges from 1 day to 6 months.

- Long-term impacts on professional licenses and business operations.

- Understanding these risks is the first step to building a solid plan to protect yourself and your business.

Business Operations Management: Ensuring Continuity

A DUI case doesn’t have to disrupt your business completely. With the right plan, you can keep things running smoothly, even during tough times. Here’s how:

Delegate Responsibilities

- Assign key tasks to trusted team members.

- Communicate who is in charge of what.

- Empower employees to take on temporary leadership roles if needed.

Set Up Communication Channels

- Ensure your team has clear and open ways to communicate.

- Keep everyone updated on changes to roles or responsibilities.

Create a Crisis Plan

- Prepare a plan to handle leadership gaps or workflow changes.

- Outline steps to ensure daily operations continue without major interruptions.

- Businesses with strong crisis plans recover faster from unexpected challenges.

With these steps, you can maintain stability and focus on resolving your legal issues while keeping your business on track.

Communication Strategy: Maintaining Stakeholder Trust

Clear and honest communication is your best tool during a DUI case. How you handle it can help you keep the trust of your business or risk losing it. Here’s how to communicate effectively:

Be Open and Honest

- Talk to employees, business partners, investors, and key clients.

- Share the situation without giving too many unnecessary details.

Focus on accountability and show that you are committed to resolving the issue and growing from it.

Manage Your Public Image

- Take control of the message about your situation.

- Proactive and transparent communication can cut negative media coverage in half.

- Show that you are taking responsible steps to address the matter.

By being transparent and staying proactive, you can reduce potential harm and maintain the trust of those who matter most to your business.

Financial Considerations: Protecting Your Economic Interests

A DUI case can come with heavy financial costs. Between legal fees, fines, and increased insurance rates, the total expense can easily exceed $15,000. To protect your business, it’s important to plan carefully and manage your finances wisely. Here’s how:

Understand the Full Financial Impact

- Look beyond just legal fees and fines.

- Consider potential lost business opportunities and increased costs to keep operations running smoothly.

- Think about the long-term effects, like higher insurance premiums or reputational damage that may affect your bottom line. Just as professionals in healthcare use services like Dental Insurance Credentialing to ensure operational efficiency and minimize risks, businesses facing legal challenges must proactively secure their financial and regulatory foundations.

Review and Adjust Your Finances

- Conduct a full review of your business’s financial health.

- Identify areas where you can cut unnecessary costs to save money.

- Make adjustments to prioritize essential expenses during this period.

Explore Financing Options

- Look into emergency business loans or lines of credit to manage unexpected expenses.

- Consider temporary financial strategies like cost-sharing agreements or payment plans for larger bills.

- Build or tap into a financial buffer to keep your business steady through this challenge.

By staying proactive and organized, you can manage the financial strain of a DUI case while protecting your business’s long-term stability. Strategic financial decisions now can make a big difference in ensuring your business stays on track.

Insurance Implications: Safeguarding Your Business

A DUI case can create unexpected financial risks, especially if your insurance policies don’t cover liabilities related to criminal acts. Many business owners don’t realize that standard insurance policies often exclude these situations, which can leave your business vulnerable.

Here’s how to protect yourself:

Review Your Insurance Policies

- Go through your current insurance policies with a professional.

- Check for exclusions related to criminal charges or other liability gaps.

Talk to Your Insurance Provider

- Ask your provider about potential risks and how they can be addressed.

- Find out if your coverage needs to be updated to protect your business fully.

Make Necessary Adjustments

- If there are gaps in your coverage, work with your provider to adjust your policy.

- Proactively updating your insurance can safeguard your business during challenging times.

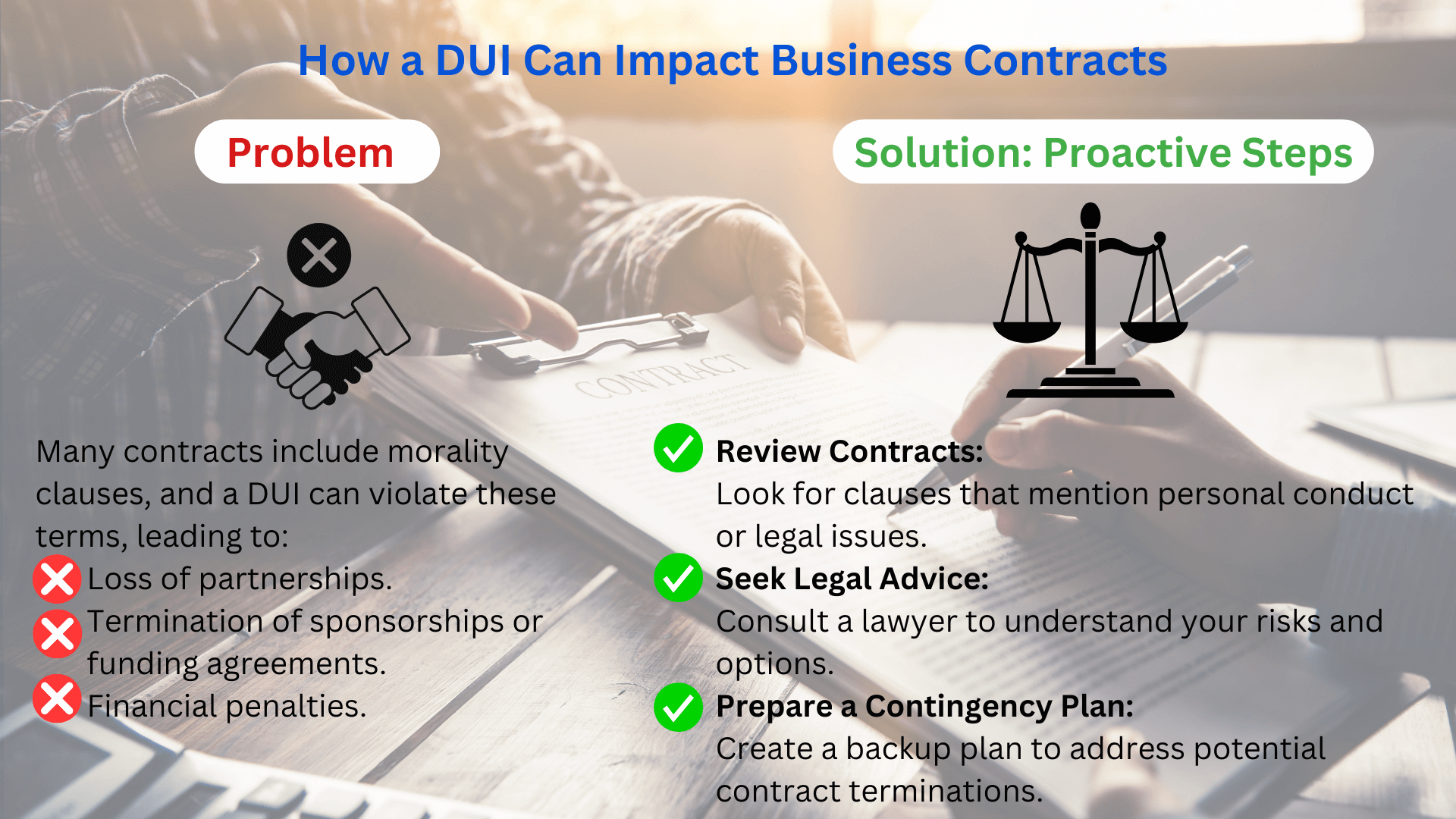

By understanding your coverage and making any needed changes, you can reduce financial risks and ensure your business stays protected. Beyond financial risks and insurance coverage gaps, a DUI can also affect your business agreements. Here’s a quick look at how a DUI can impact your contracts and what to do about it.

Reputation Management: Rebuilding Trust

Your business’s reputation is a delicate asset that requires careful management during legal challenges. The way you handle this situation can either strengthen or undermine your professional credibility.

Consider engaging in community service initiatives, participating in professional development programs, or seeking opportunities for public speaking that demonstrate your commitment to personal growth and accountability. Utilize media monitoring tools to track public sentiment and develop responsive communication strategies.

Personal Well-being and Leadership: Navigating Personal Challenges

Your resilience directly impacts your business’s recovery. Professional counseling can provide essential support during this challenging time, helping you maintain mental health and leadership effectiveness.

Lead by example by maintaining professional composure, showing commitment to personal growth, and inspiring team confidence. Your ability to navigate this challenge with grace and determination can strengthen your leadership and team’s respect.

Securing Your Business and Reputation After a DUI Case

A DUI charge may feel like a moment of crisis, but it’s also an opportunity to show your resilience and strength as a business leader.

By taking immediate legal action, managing your operations strategically, and communicating openly, you can minimize the impact on your business. Remember, this challenge doesn’t define you or your business, it’s how you respond that shapes your future.

Use the strategies in this blog to protect your business, rebuild trust, and demonstrate leadership that inspires. The steps you take today will safeguard your present and also lay the foundation for a stronger tomorrow.

Frequently Asked Questions

How can a DUI charge affect my business operations?

A DUI can create legal complications, reputational damage, financial strain, and operational disruptions, particularly if you play a central role in daily business activities.

What steps protect my business’s reputation after a DUI charge?

Focus on transparent communication, engage in community service, and develop a strategic public relations plan to rebuild trust.

Will my business insurance cover DUI-related liabilities?

Coverage depends on specific policy terms. Always review your insurance agreements and consult your provider to understand potential exclusions.

Leave a Reply