How Collections and Late Payments Impact Credit Scores Long Term

Payment history plays a major role in determining a person’s credit score. When late payments or collection accounts appear, they can significantly reduce creditworthiness and influence financial opportunities for years. Understanding how these factors work helps anyone manage their credit more effectively and take practical steps toward improvement.

Understanding the Weight of Payment History

Payment history typically makes up the largest portion of a credit score. Even one missed payment can have a noticeable effect. The longer a payment remains unpaid, the more damaging it becomes. Accounts that are 30, 60, or 90 days late are reported differently, with severity increasing over time.

Lenders view consistent payment behavior as a sign of reliability. When payments are late, it signals potential financial instability. This risk is reflected in the score, which can cause higher interest rates or declined credit applications.

What Happens When Accounts Go to Collections

When a debt remains unpaid for an extended period, the creditor may transfer or sell it to a collection agency. This action creates a new collection account on the credit report, often resulting in a significant score drop. The presence of a collection suggests that the borrower failed to meet their obligations, which can remain visible for up to seven years.

Even if the debt is later paid, the collection record itself can continue to impact credit health. However, some scoring models give less weight to paid collections, recognizing the effort made to settle the obligation.

Types of Accounts Affected

Collections can stem from various sources, including medical bills, credit cards, or utility accounts. Regardless of the source, the impact on credit tends to be similar. The size of the debt matters less than the fact that it reached collection status, which reflects negatively on financial responsibility.

Long-Term Effects on Credit Scores

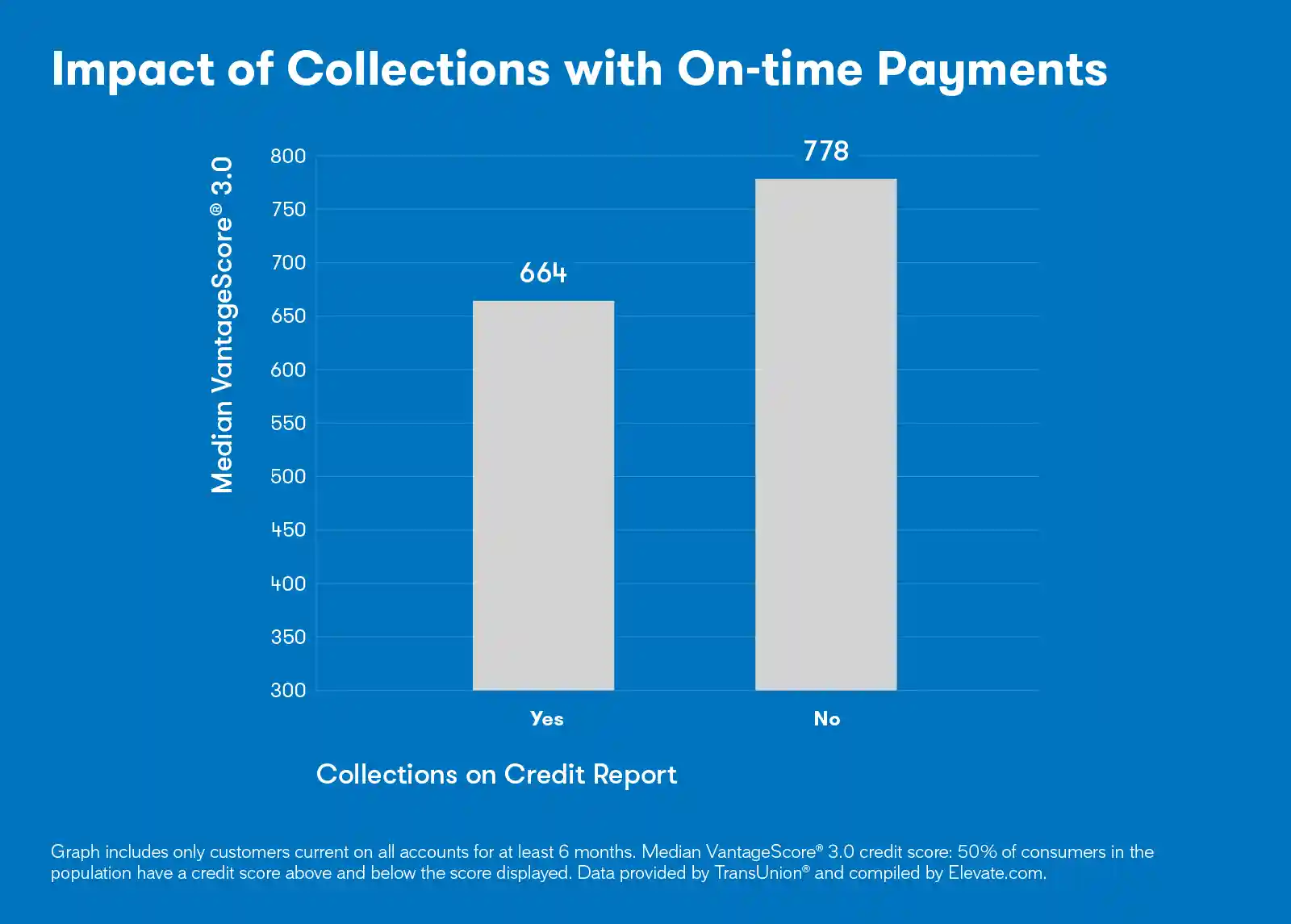

Late payments and collections can influence credit scores for several years. Even as time passes, their presence in the payment history section continues to lower the overall score. Fortunately, the impact lessens gradually as positive behavior is demonstrated over time.

Maintaining timely payments and reducing outstanding balances are key to recovery. As newer, on-time payments replace older negative marks, credit scores often begin to improve.

Recovery Through Responsible Credit Management

To rebuild after financial setbacks, it helps to learn how credit repair works. This process typically involves reviewing credit reports, disputing inaccuracies, and adopting consistent payment habits. Monitoring reports regularly ensures that progress is visible and that any errors are quickly addressed.

Some individuals also explore professional guidance through credit repair services in Texas. Such services can assist in identifying problem areas, negotiating with creditors, and creating structured repayment strategies. They provide an organized approach for improving credit profiles over time.

Building Positive Credit Habits

Good credit habits are the foundation of lasting improvement. Setting up payment reminders, keeping balances low, and avoiding unnecessary new accounts are effective strategies. Over time, these habits demonstrate reliability and help offset the effects of past delinquencies.

- Pay all bills on or before the due date.

- Keep credit utilization under 30 percent of available limits.

- Review credit reports at least annually for accuracy.

- Address any new issues promptly to prevent escalation.

Developing a stable financial routine not only supports higher credit scores but also promotes overall financial confidence. While collections and late payments can leave lasting marks, consistent effort and responsible use of credit can steadily rebuild trust with lenders and open doors to future opportunities.

Leave a Reply