Simplify Retirement Planning With FIREkit

Understanding Retirement Planning

You might have at least once heard people talking about retirement planning. Have you ever wondered what exactly people mean about their retirement planning? To explain in very simple terms, retirement planning is the process of setting financial goals and developing a plan for the allocation of your investments according to the set goals in order to make a secure and comfortable life after work. This planning involves estimating future expenses, putting savings away, and managing investments to earn sustainable income over time. Proper retirement planning is important to enable us to attain financial independence, freeing us from the problems of money as we cool down in our sunset years.

Most people tend to leave the thought of retirement planning until later stages in their lives and I don’t know when this later comes; however, early initiation means compound growth and security. Rising costs of living coupled with unpredictable economic shifts have made it increasingly necessary to plan for retirement. If you are someone who is seeking more of a streamlined approach toward the retirement planning process, the FIREkit retirement calculator is the best choice for you. It supports the users in defining their financial goals, tracking their progress, and making well-informed investment decisions, rendering the complete process simpler and more efficient.

Importance of Early Finances Management

As mentioned, many people tend to leave this retirement planning to their later stages and fail to do so. So, before even you decide on your retirement planning at the time of your retirement let me tell you the importance of early financial management:

1. Financial Security in Retirement

If you haven’t done your financial planning, you may well be left with scant governmental benefits that barely pay for the essentials. But if you have already started your planning, then sufficient funds would have been already set aside for your retirement and future worries would have been ruled out, before you even worry.

2. Beating Inflation

You might be well aware that inflation makes our money lose value over time. So, we must have a good retirement plan as a good retirement plan considers inflation beforehand to protect against savings becoming useless over the period of years.

3. Avert Financial Stress Last Minute

Over time I have understood that planning things ahead helps a lot no matter what we are planning ahead for like our day-to-day tasks or weekly tasks. So, in this sense, as well planning ahead also shields people from the worry of a financial crunch close to retirement age. When a peril is duly avoided, it can only meet its demise when passing. Am I right?

4. Better Growth of Investment

The early you start the better the results. And it also gives you more time for your investments to grow. One more best thing about long-term investment regarding shares and bonds is that they tend to benefit from compounding over the longer term and it is the best recipe for very large wealth accumulation.

How FIREkit Simplifies Retirement Planning?

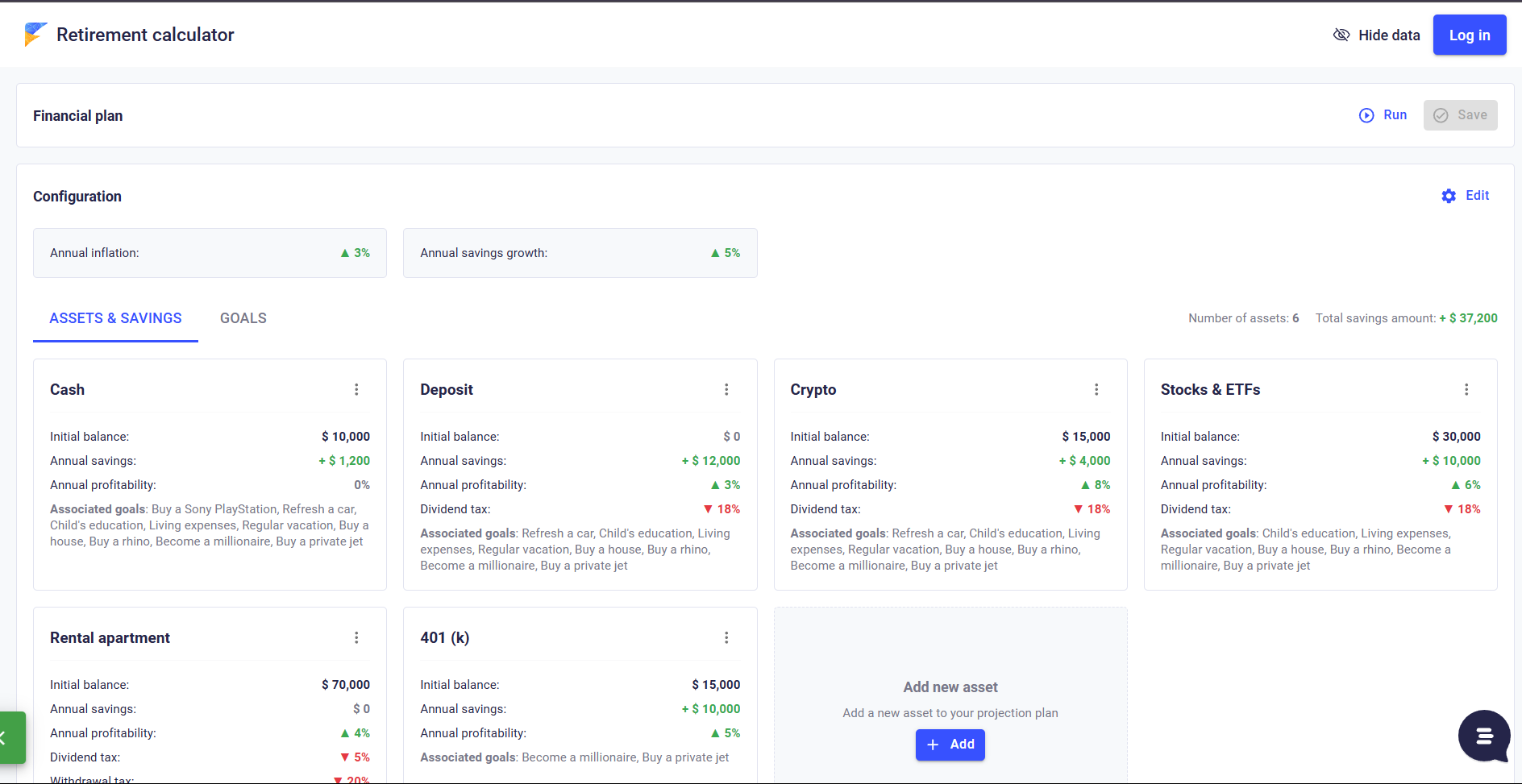

Now, let’s come to the case of how FIREkit can simplify our retirement planning. Is more than a retirement planning tool; it is a full-fledged financial management platform. Here is how it helps:

1. Built-in Retirement Calculator

FIREkit’s retirement calculator simplifies financial planning by helping us estimate how much we need to save, how our investments will grow, and whether they are on schedule to meet these goals. We will have to input our current savings, anticipated expenses, and investment plans to create a personalized path for our retirement.

2. Financial Goals Setting

FIREkit helps us to set a clear definition for our financial goals. Whether it is an early retirement, lifestyle provisions, or preparations for unforeseen medical costs, the FIREkit definitely has some organized ground to set those expectations.

3. Tracking Progress

Users can use FIREkit to monitor our progress continuously to keep us on the line regarding contributions towards retirement savings. The visual reports provided by the tool allow us to make required adjustments concerning market conditions and personal changes in finances. And visual reports are pretty good and are very user-friendly.

4. Monitoring Asset Growth

As we know, market value in terms of investments and even trading varies over time, this makes it a necessity for monitoring asset growth. FIREkit offers its users insights into how their investment performs over time, pinpoints trends, and highlights areas for improvement to maximize returns.

5. Cash Flow Analysis in Detail

One of the most important aspects of financial planning is the analysis of cash flows: cash inflow and cash outflow of a certain portfolio. FIREkit thoroughly analyzes the cash flow and provides useful information concerning the sources of income, expenditures, and returns on investments of the overall financial situation.

FIREkit as an Investment Tracking and Analysis Tool

In addition to retirement planning, FIREkit is a great tool for investment tracking and analysis. It offers us various tools that help will help us to:

Analyze Our Portfolio Performance: FIREkit offers a best Portfolio visualizer where users can easily assess how their investments have been performing over time.

Diversify Investments: The asset allocation insights provided by FIREkit allow users to balance their portfolios for optimum growth and risk management.

Optimize Savings Strategy: Using automated calculations, users see how much they should realistically save each month to get to their desired retirement age.

Change Plans According to Market Movement: With real financial updates made available to the platform, users can change their plans as required.

The Future of Retirement Planning with FIREkit

The traditional way of doing one’s retirement plan tends to be complicated and time-consuming. FIREkit, on a very different note, changes all that by introducing an intuitive, all-in-one platform for financial planning, investment tracking, and goal-setting.

If users leverage the FIREkit retirement calculator to the fullest, they will stake their lives in their hands, in preparation and the right conditions for their after-work.

Conclusion

Retirement planning is one of the roots of financial security and advanced financial management is the key to a secure and worry-free tomorrow. FIREkit renders an advanced, efficient, and user-friendly alternative to assist in taking control of one’s retirement planning with pride.

Whether one is just getting started in their life or fine-tuning their existing retirement strategy, FIREkit supplies the tools needed to make good life choices. Begin planning today and secure the most deserving fund of funds.

Leave a Reply